Generate Instantly W-2 Form Online!

The IRS mandates that organizations file a W2 Form for each employee in order to provide proof of all wages received and taxes paid.

Generate NowHow It Works?

Step 1

Enter Your Information

Step 2

Preview Your Document

Step 3

Download Document InstantlyWhat is a W2 form?

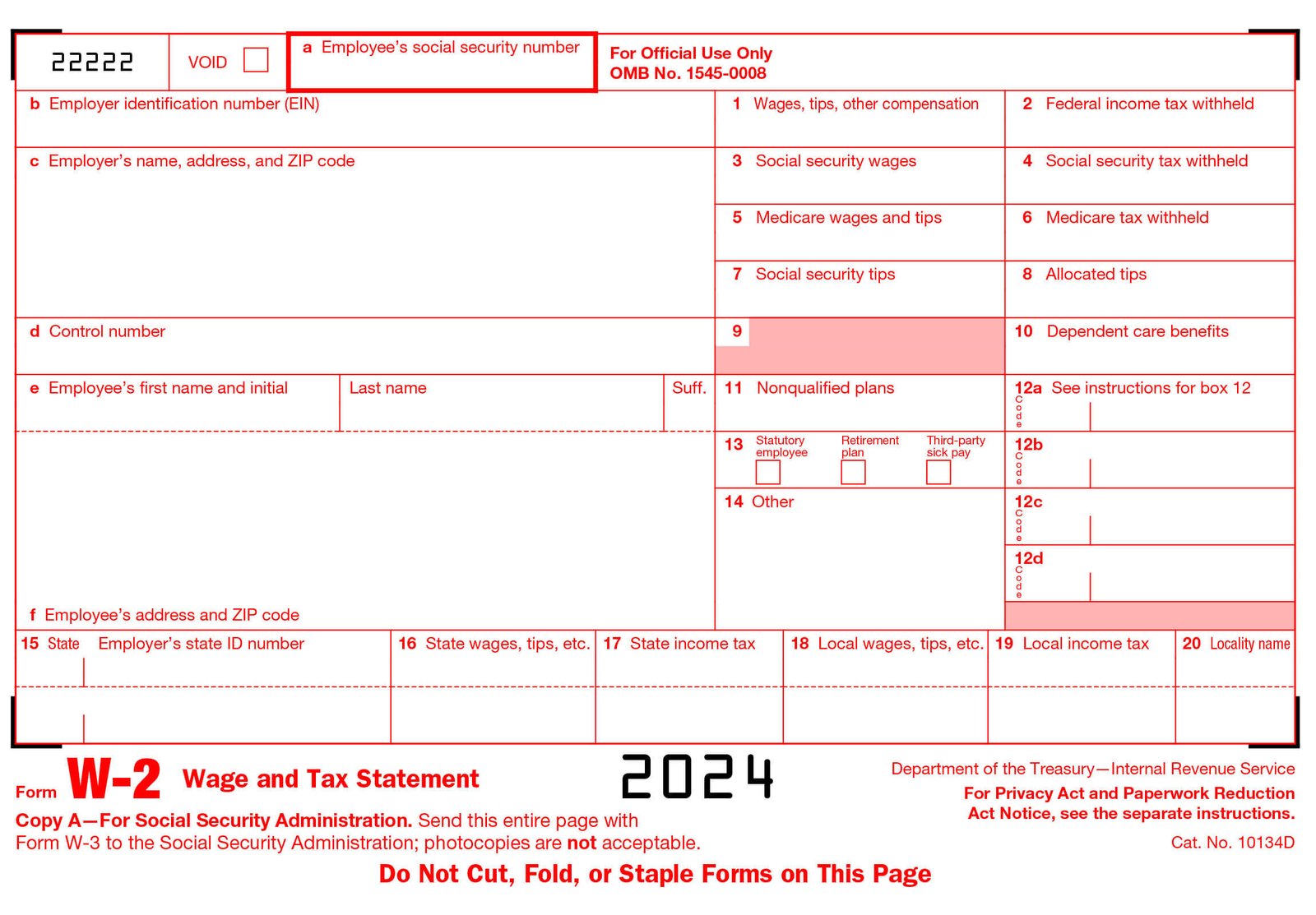

Your business must annually submit the W2 Form, commonly known as a Wage & Tax Statement, to each employee and the IRS. The Form’s objective is to list the salaries paid and taxes deducted for every worker of your business.

Why do you require it?

- If you’re a business owner

Employers are required by the IRS to deduct taxes from employees’ paychecks during the course of the year and then pay those taxes to the IRS. The IRS mandates that organizations file a W2 Form for each employee in order to provide proof of all wages received and taxes paid. W2s must also be distributed yearly to each employee by businesses as required by law.

- If you’re a worker

You have the right to get an annual printable W2 form from your company if you are an employee. These will be needed when you submit your yearly tax return and are generally made accessible in the first few months of each calendar year.

Useful Hints and Guidelines

Many online printable W2 templates use the “data only” copy from the IRS, which has the second page written in red. If you submit the red version to the IRS, then you will risk fines.

Use the legitimate printable W2 Form approved for submission to the IRS instead. This copy, which is accessible through the URL on this page, will be printed with all pages in black.

The printable W2 Form’s completion is a simple procedure. Name, social security number, wage details, address, and quantity of income tax, Social Security tax, and Medicare tax withheld must all be provided.

You should be aware that you must provide the Social Security Administration with a copy of each employee’s W2 Form. Using a template for a W2 form won’t work for this. You must then submit the paperwork on the SSA’s website.

Wage and Tax Statement completion in 2024

The following details are required:

- A worker’s SSN.

- EIN, name, address, and zip code of the employer.

- Name, address, and contact information about the organization.

- Name and contacts of the employee.

- Tips and wages.

- Taxes.

Payroll and Tax Statement W2 forms must be filled out completely in order to be successful. Fill up the document part by section using a straightforward tool like Stubbuilder. This page allows you to open a blank W2 form that you may modify, print, or just save as a W2 form PDF.

In order to record earnings and taxes that were paid over the course of a year, this documentation was produced for both employers and their staff. Before-tax season, employers should fill it out and send it to all of their employees. For reporting their tax returns, employees should utilize this Form.

Fill it up with Stub builder, distribute it to your staff, or just email it to them. For your comfort, we included autofill, so you just need to complete the first page. All other pages will automatically copy information.

When does an employee get their printable W2 forms or W2 form pdf?

All companies must provide these copies to their staff members by January 31 of the current year, according to the IRS. It must be submitted after the end of the accounting year, which is typically on December 31 each year. If you don’t get your copy until then, you should get in touch with your employer, and if you don’t receive a response, you can take the IRS further.

Latest Trends and Insights

Create Accurate Paystubs Online in Just a Few Clicks

Jun 9, 2025Whether you’re a self-employed entrepreneur, a freelancer, or a small business owner,…

read more

Hobby Lobby Employee Login: Step-by-Step Guide

Jun 5, 2025If you work at Hobby Lobby or used to in the past,…

read more

Why Using a Trusted Pay Stub Generator Prevents Payroll Errors?

Jun 3, 2025A pay stub is a document that is provided by employers to…

read more